Activities

Our books and courses

Accessible language instead of convoluted theoretical deductions. Our publications and on-line courses provide practical answers to the questions of entrepreneurs.

Read more

The two-part publication consists of almost 1000 practical questions and answers related to the limited liability company. It covers legal, tax, and accounting issues. The first part of the book entitled “How to set up and organize a company well?” (How to form and structure a company well) is a practical guide to what is especially important at the beginning of the adventure with a limited liability company. The second part of the book entitled "How to finance a company and make changes in it?" is a practical guide to issues that are particularly important for an already operating limited liability company.

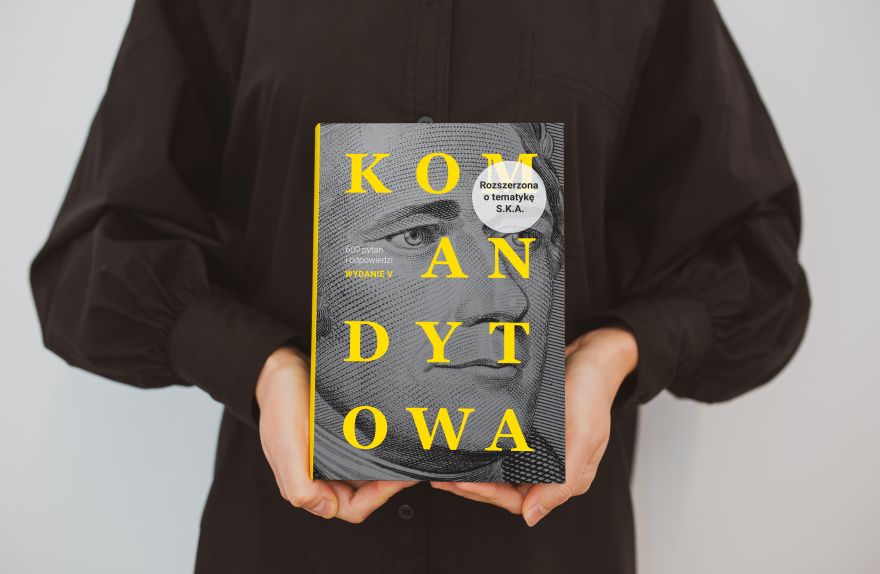

The book is 600 practical questions and answers related to the limited partnership. It covers issues in the operation of a limited partnership and addresses problems in commercial law, tax law and accounting. It is the only practical compendium of knowledge about the limited partnership on the market.

The publication is a practical guide to business succession. Everything you need to know about business succession from a legal and tax perspective is included in 333 questions and answers.

During the course, we clarify the biggest doubts about the transition to the Estonian CIT. We explain legal, tax and organizational issues that will allow you to easily understand the principles of operation and their settlement.

Learn more about the latest regulations regarding family business and discover its greatest advantages in our course!

Limited Liability Company Course was made by practitioners for practitioners, no theory needed! Our specialists have prepared over 4 hours of film materials supported by the experience of many years of work with our clients.

Learn the ins and outs of how a limited partnership and limited joint-stock partnership operate and account for themselves. In our course you will find the biggest advantages of these partnerships!